Maximizing ROI: Unraveling The Impact Of Software Development Depreciation – Act Now!

Software Development Depreciation: An Overview of Its Impact and Importance

Greetings, Readers! Today, we delve into the world of software development depreciation. As technology continues to evolve at an unprecedented rate, it is essential for businesses to understand the concept of software development depreciation and its implications. In this article, we will explore the what, who, when, where, why, and how of software development depreciation, as well as its advantages, disadvantages, and frequently asked questions. So, let’s get started!

What is Software Development Depreciation?

🔍 Software development depreciation refers to the gradual decrease in the value of software over time. Just like any other asset, software has a limited life span and becomes less valuable as it ages. This depreciation is influenced by factors such as technological advancements, changes in business requirements, and the introduction of new software solutions.

2 Picture Gallery: Maximizing ROI: Unraveling The Impact Of Software Development Depreciation – Act Now!

📆 The depreciation of software typically begins after its development is complete and it is put into use. The initial cost of developing the software is spread over its estimated useful life, and the decrease in value is recorded as an expense on the company’s financial statements.

🏢 Software development depreciation affects various industries, including finance, healthcare, manufacturing, and entertainment. Regardless of the sector, businesses must understand the impact of software depreciation on their operations and financial statements.

Who is Affected by Software Development Depreciation?

👥 Software development depreciation impacts both software developers and businesses that rely on software for their operations. Software developers need to consider the estimated useful life of their products when determining pricing strategies and projecting revenue streams. On the other hand, businesses using software must account for its depreciation to make informed decisions about upgrades, replacements, and budget allocations.

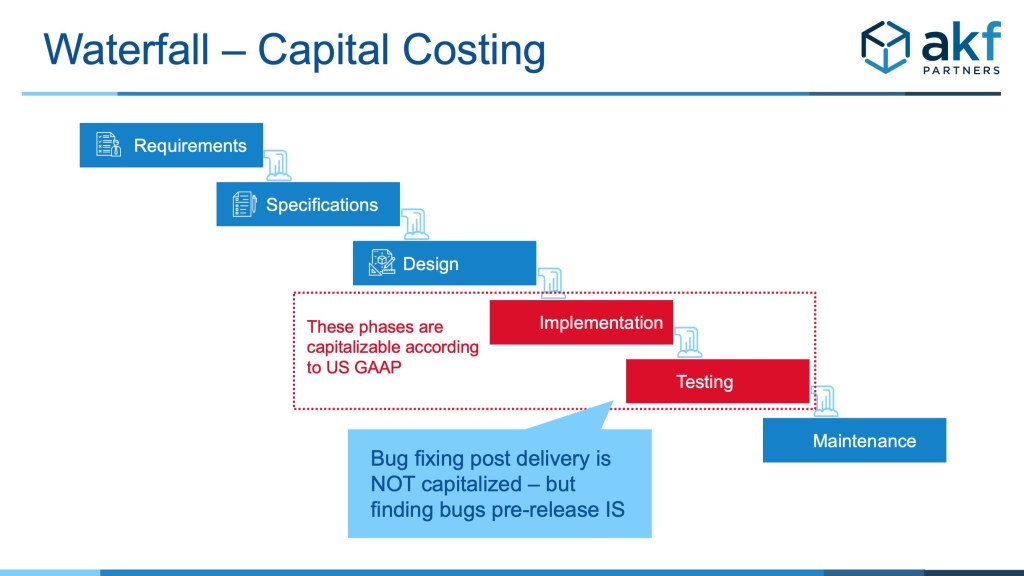

Image Source: akfpartners.com

👨💻 Developers, project managers, CFOs, and IT professionals all play crucial roles in managing software development depreciation. Collaboration between these stakeholders is essential to ensure that software assets are utilized efficiently and that the impact of depreciation is minimized.

When Does Software Development Depreciation Occur?

⏰ Software development depreciation begins once the software is put into use. The rate at which depreciation occurs depends on several factors, including the complexity of the software, the pace of technological advancements, and the industry in which it is used. Generally, software depreciates over a period of three to five years, although this can vary significantly.

⚙️ Additionally, software development depreciation may occur when a new version or upgrade of the software is released. This can render the previous version less valuable and make it more susceptible to depreciation.

Where Does Software Development Depreciation Apply?

🌍 Software development depreciation is a global phenomenon that applies to businesses and software developers worldwide. Regardless of the geographical location, software assets are subject to depreciation due to the ever-changing nature of technology.

🌐 Moreover, with the rise of cloud-based software solutions, businesses can access software from anywhere in the world. This accessibility introduces new considerations for depreciation, as businesses must evaluate the impact of technology advancements and ensure they are utilizing the most up-to-date software.

Why is Software Development Depreciation Important?

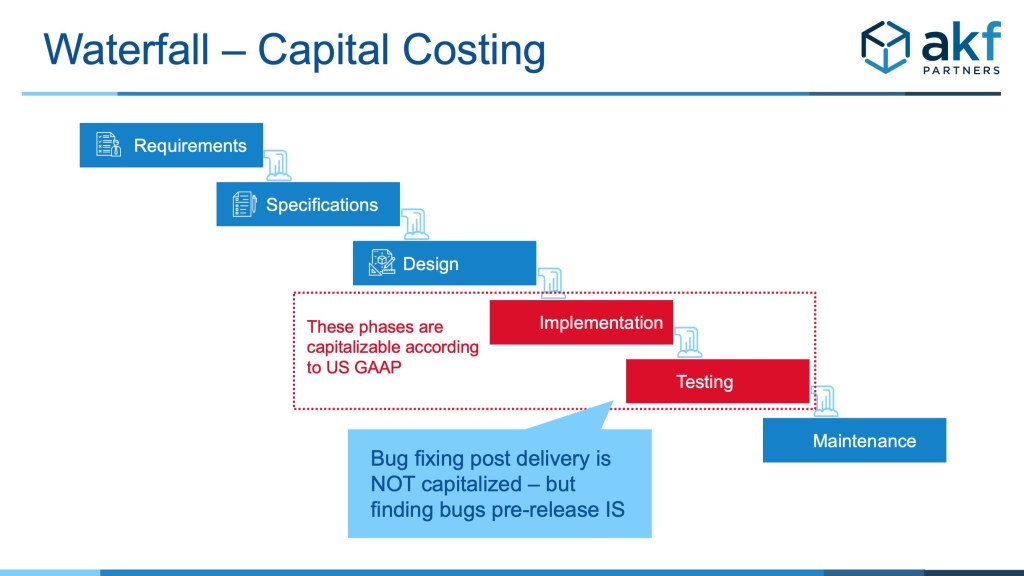

Image Source: swipsystems.com

💼 Software development depreciation is crucial for businesses to understand because it directly impacts their financial statements and profitability. By accounting for software depreciation, businesses can accurately reflect the value of their software assets and make informed decisions regarding upgrades, replacements, and investments in new technology.

💸 Additionally, understanding software development depreciation helps businesses manage their budget effectively. By forecasting the decrease in software value, they can allocate funds for future upgrades and replacements, minimizing financial surprises.

How to Manage Software Development Depreciation?

📊 Managing software development depreciation requires careful planning and collaboration between software developers, project managers, and finance professionals. Here are some strategies to effectively manage software development depreciation:

1️⃣ Regularly assess the value and functionality of software assets to identify when upgrades or replacements are necessary.

2️⃣ Stay informed about technological advancements and industry trends to anticipate the impact on software value.

3️⃣ Collaborate with software developers to understand the estimated useful life of their products and align it with business goals.

4️⃣ Implement proper documentation and tracking systems to monitor software assets and their depreciation over time.

5️⃣ Consider the option of leasing software instead of purchasing it outright, as this can reduce the financial impact of depreciation.

Advantages and Disadvantages of Software Development Depreciation

👍 Advantages:

1. 🚀 Keeps businesses technologically updated by encouraging regular upgrades.

2. 💸 Allows for accurate financial reporting and budgeting.

3. 🌐 Encourages innovation and the adoption of new technology.

👎 Disadvantages:

1. 💰 Can be costly to regularly upgrade or replace software.

2. ⏰ Requires careful monitoring and planning to minimize financial losses.

3. 📈 Depreciation rates can vary and are influenced by external factors, making accurate forecasting challenging.

Frequently Asked Questions (FAQ)

Q1: What is the difference between software development depreciation and software obsolescence?

A1: While software development depreciation refers to the decrease in value over time, software obsolescence occurs when software becomes outdated or no longer meets the needs of the business.

Q2: Can software depreciation be reversed?

A2: No, software depreciation is irreversible. Once the value of software decreases, it cannot be restored.

Q3: Is software development depreciation tax-deductible?

A3: In many countries, software development depreciation is considered a tax-deductible expense. However, specific regulations may vary, so it is essential to consult with a tax professional.

Q4: How often should software assets be reassessed for depreciation?

A4: Software assets should be reassessed regularly, ideally annually, to ensure their value is accurately reflected in financial statements.

Q5: Can software development depreciation impact the resale value of software?

A5: Yes, software development depreciation can impact the resale value of software, as potential buyers consider the age and functionality of the software when determining its value.

Conclusion

In conclusion, software development depreciation is a critical aspect of managing software assets for both developers and businesses. By understanding the what, who, when, where, why, and how of software development depreciation, businesses can make informed decisions regarding their software investments. By effectively managing software development depreciation, businesses can stay technologically updated, accurately report their financials, and allocate resources efficiently. So, embrace the concept of software development depreciation and leverage it to drive your business forward!

🌟 Now is the time to assess your software assets, collaborate with software developers, and develop a solid strategy to manage software development depreciation effectively. Stay ahead of the technological curve and ensure your software investments are optimized for success.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as professional advice. Consult with a qualified expert before making any decisions related to software development depreciation or any other financial matter.

This post topic: Programming